Table of Contents

General Ledger (G/L) Number Accounts

General ledger numbers (also called general ledger accounts) are the accounts that all costs, receipts, and inventory charges must go against. Taken all together, they form the complete general ledger, the total accounting ledger for your company.

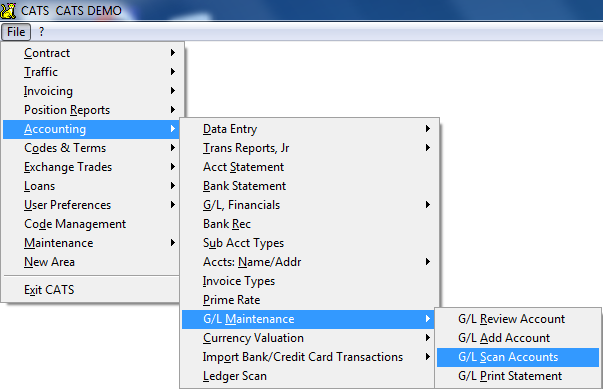

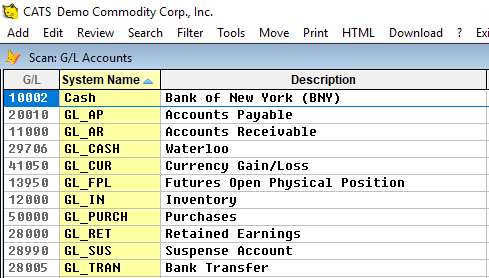

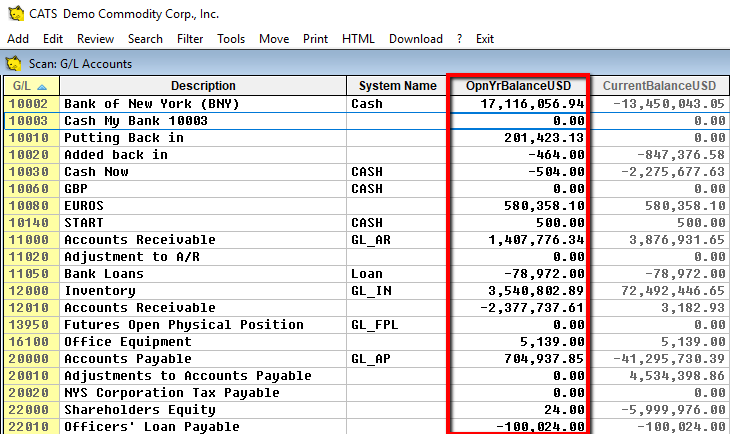

These numbers are stored in the Accounting > G/L Maintenance > G/L Scan area.

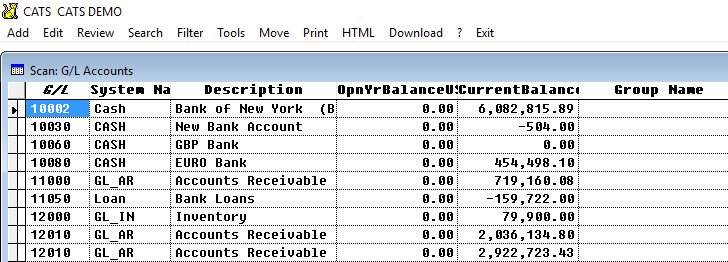

From the scan you can see the opening and current balances for each G/L number, as well as assignments for the chart of accounts.

Use the toolbar menu to Add or Edit G/L codes from the scan.

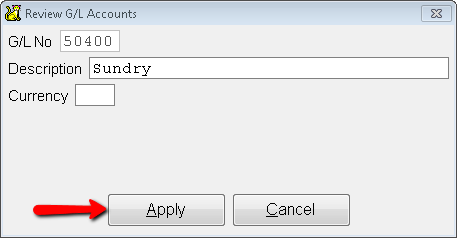

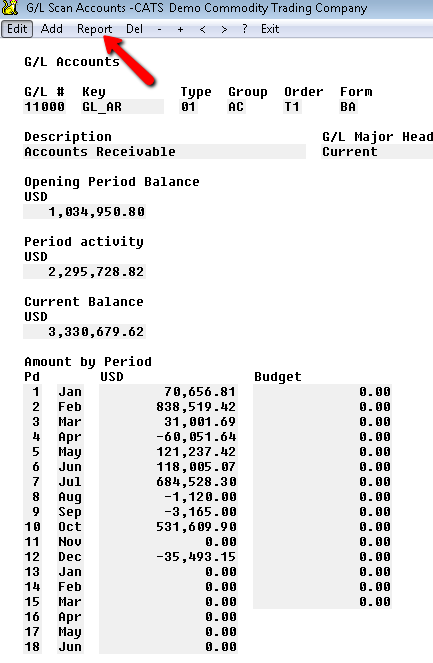

Select Apply to exit and see a summary of the code’s properties and amounts by accounting period.

Pick Report from the menu to go to the G/L statement report, which can also be found in the Accounting > G/L Financials > G/L Statement area.

Special/System G/L Accounts

Certain general ledger accounts should always be present in the system for proper usage of CATS and proper accounting procedures. They are denoted by what is shown in the Key field on the account review screen, called System Name in the scan.

These include:

- Cash Accounts - These are bank accounts. They can only be used to enter transactions via a bank. The Key field on these accounts should read

CASH. - Accounts Payable - The Key fields on this account should read

GL_AP. - Accounts Receivable - The Key field on this account should read

GL_AR. - Inventory Account - The Key field on this account should say

GL_IN. - Bank Transfer Account - Used to process bank transfers, as the offset account. The Key field on this account should say

GL_TRAN. - Suspense Account - Used to transfer money internally and for temporary placement of transactions. The Key field on this account should say

GL_SUS. - Retained Earnings Account - Takes the sum of Expenses and Revenue accounts and condenses them into one account for the purposes of reporting (on the Balance Sheet). The Key field on this account should read

GL_RET. - Inventory Adjustment Account - General journal entries should be made into this account for the value of inventory, to see a complete picture of your profit and loss. Values from the Inventory Transactions, Futures, and Overall Position reports are used to create these journal entries.

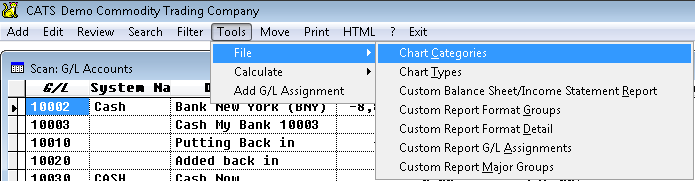

Chart of Accounts/Tools menu

From the G/L Scan, you can also set up the Chart of Accounts. The chart of accounts is the way G/L numbers are grouped on the Trial Balance, Balance Sheet, and the Income Statement.

Pick Tools > File > Chart Categories to change the G/L Assignment for these reports.

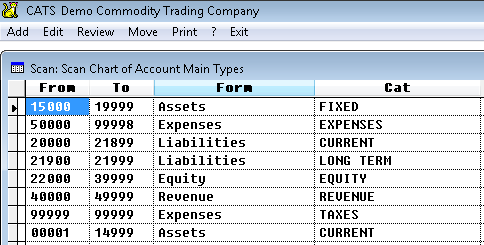

CATS will show you the current Chart of Accounts Main Types. Each Form type has a beginning and ending G/L number. All G/L numbers that fall between these two numbers will be in that category.

Pick Exit to return to the G/L Accounts scan.

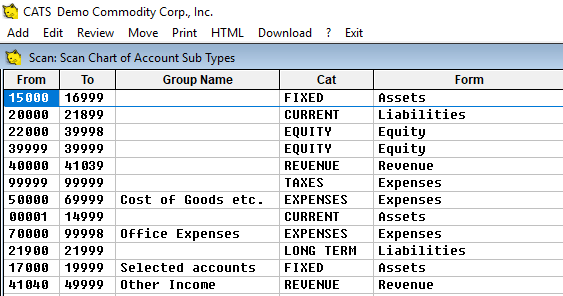

You can also go to Tools > File > Chart Types to view or change the account Chart Types assignment.

Setting Opening Balances

Occasionally, you may need to alter the opening balance for G/L accounts in CATS. You can do so from the G/L Scan Accounts area.

Enter the opening balances in the OpnYrBalanceUSD column (or the OpnYrCurBalance column if this G/L account is for a non-default currency).

Even if you change the opening balances for the system GL_AP and GL_AR accounts, CATS will still calculate them on its own. This is how you end up with discrepancies on the accounting recalculation.