Table of Contents

Understanding Transaction Codes in CATS

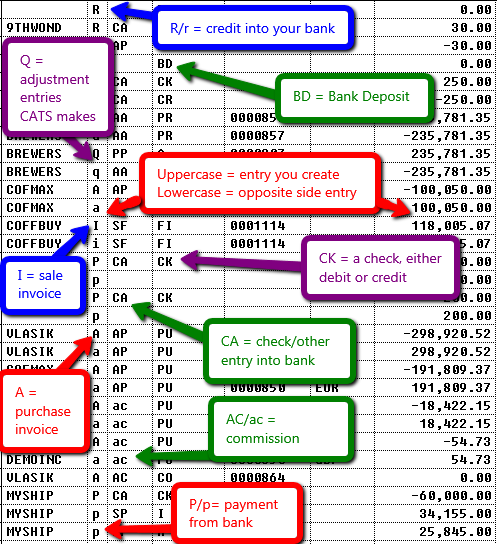

You can see transaction codes on reports and in the general ledger scan. In general, the transaction in uppercase is the entry you put in, and the lowercase part is the proof amount/opposite side entry.

Transaction-Related Codes

Under the T (Type) column, you can have the following transaction-related codes.

- R/r = Credit into G/L account/bank.

- P/p = Debit from G/L account/bank.

- Q/q = General journal entry - does not use a bank.

Under the TrCd column, you can have the following transaction code types.

- BD = Bank deposit, part of a receipt.

- AC/ac = Commission invoice.

- CK = A check (disbursement).

- bt = Bank transfer.

- fx = Foreign currency adjustment.

Invoice-Related Codes

Under the T column, you can have the following values for invoices.

- OP/OA = On account invoices.

- I/i = Sale invoice.

- A/a = Purchase Invoice.

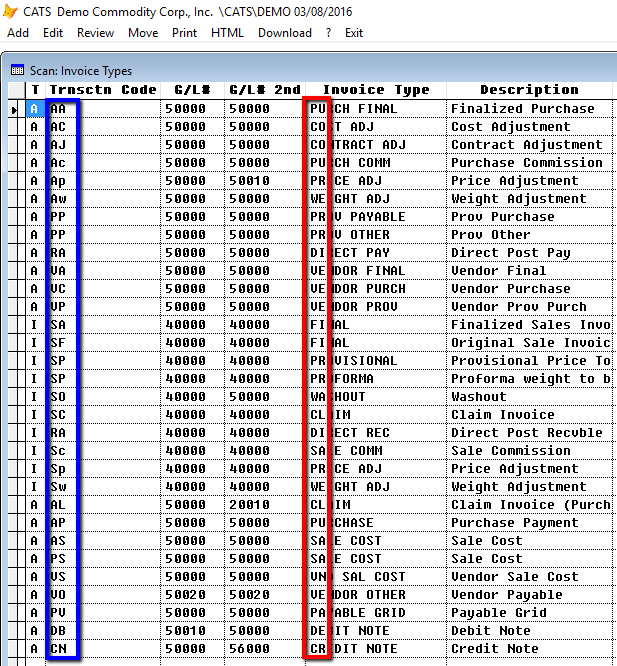

In addition to the main invoice type code, CATS uses the following fields from the Accounting > Invoice Types code file.

- * Transaction Code - This two-digit code was created when this invoice type was set up. This populates the

TrCdcolumn of the general ledger. - * Invoice Type - The first two letters are used for the invoice type. This is pulled into the

InvoTypecolumn.

Automatic Codes

Q/q = Entries CATS makes to adjust balances. Q entries can be used to move balances from provisional invoices to their related final invoices.

Sample Entries

Here is a sample G/L scan with entries of most types available.

Combining the two codes, we can interpret the type of transaction. Examples include:

I SF FIis one side of a posted sales invoice, andi SF FIis the opposite side.A AP PUis one side of a posted purchase invoice, anda AP PUis the opposite side.P CA CKis the top line of a disbursement, andpis used for each application of the disbursement.