Table of Contents

Closing the Financial Year in CATS

At the end of every financial year, all information for that year should be verified for accuracy and checked against other records, such as those received from banks and auditors. Then the accounting periods should be frozen and moved to the history file to prevent users from making entries that change the year's totals. This is called “closing the year” in CATS. This process is essential to preserving all data in CATS for historical and auditing purposes.

Make sure that the data in the current and end-of-year isolation is accurate before closing the year.

Before Closing the Year

The following steps should be made before closing the financial year in CATS:

- Ensure that the information in the isolated area to be used as the year end is correct. If you have made any changes to the current area that need to be reflected in the isolated area, you will need to re-isolate or make changes in the isolated area.

- Run the Accounting Recalculation in the end-of-year isolated period and correct any errors that may appear on the report.

- Make sure the ending balances in the isolated area match the G/L trial balance. These balances will be brought forward as the opening balances in the beginning of the new year.

- Post or delete all pending invoices dated from before the year-end close. If invoices need to be unposted and corrected, do so before running the year end procedure. Once the year is closed, CATS will not allow the posting of invoices from the prior year.

- Enter and post all accounting transactions dated from before the year-end close.

- Check that the General Ledger has an account for the Retained Earnings consolidation entries. Make sure the “System” field for this ledger account is set to

GL_RET.

- Back up the data from the current period and from the year-end isolated period.

- Run the Check Contracts procedure and, if needed, reindex all files.

- ALL USERS MUST BE OUT OF CATS BEFORE YOU BEGIN THE CLOSE YEAR PROCESS

The Close Year Procedure

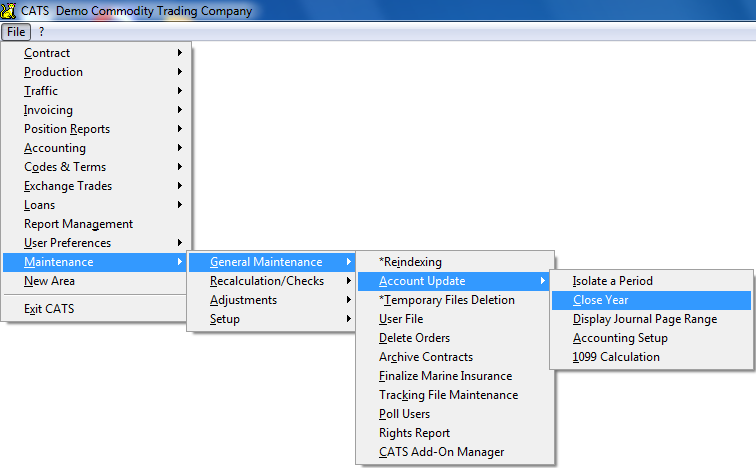

In CATS, from the File menu, select Maintenance > General Maintenance > Accounting Setup > Close Year.

CATS will ask you for the standard password.

After you input the password a menu will pop up allowing you to edit the selections for the close year process.

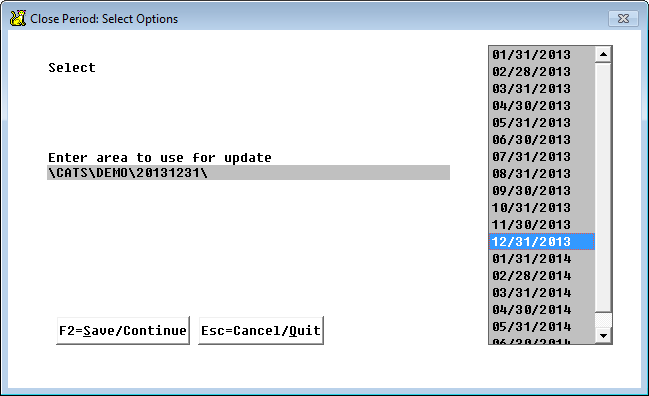

Choose Setup to change the accounting period to use to close the year. Select the appropriate accounting period from the list on the right, then choose Save to continue closing the year.

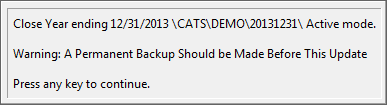

As CATS warns you, a secure and permanent backup should be made right before the year is closed.

Click anywhere to proceed.

Choose All to begin the year-end close process.

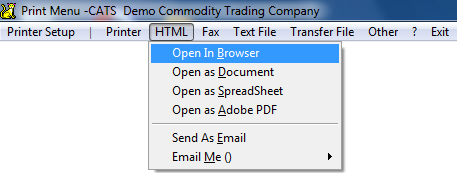

Choose where to print the result from the usual CATS print menu. For easy viewing, pick HTML > Open in Browser.

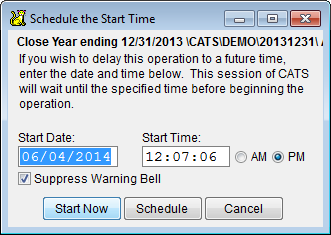

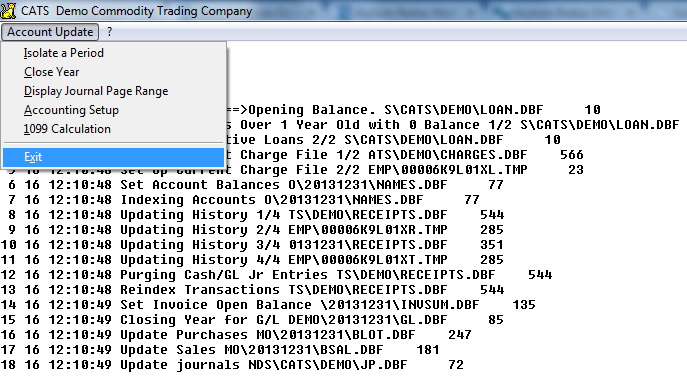

After reviewing your selections, click the Start Now button to begin the process. Data will flash on screen as CATS closes the year.

When it has finished, CATS will display the Maintenance Menu and you can Exit to continue working in CATS.

Automatic Changes Made by CATS When Closing the Year

- Loans - Loan balances become opening balances. Inactive loans are removed.

- 1099 - Recalculates all of the 1099 values for records within the year selected.

- Set up current charges - Current period inventory transactions include only transactions with dates later than the closing date of the period.

- Set Account Balances to Opening Values - Account opening period balances are set to the current balance. A/R and A/P and bank balances are updated.

- Update History File - G/L transactions for the period being closed are moved into the history file.

- Purging Transaction File - All completed transactions from before the current year are removed.

- Setting Invoice Balances - The opening period balance for any open invoices is set to the current balance. Open invoices, A/R, and A/P carrying over from the prior year are retained.

- General Ledger - Revenue and expense accounts are zeroed by summing them and placing the result into the Retained Earnings account. Ledger account opening balances are copied from the end-of-year isolated area.

- Purchase - Opening period quantities and amounts are set for purchases.

- Sales - Opening period quantities and amounts are set for sales.

- Update Journal Pages - Journal Page numbers for the start of the period are recorded.

- Check That Journals Have Been Printed - All journals should be printed before closing a period. Otherwise transactions from the journals will cover two periods. The opening pages for journals for the new period are set. The date of last update will be reset. The update date must be the last day of the month.

After Closing the Year

- Check that the ending balances from the end-of-year isolated period match the current area's opening balances.

- Move the accounting periods forward one year in the current area. The current area's Period 1 should be the first period of the new year (e.g. January 31). Be careful not to run this procedure in the isolated area. The end-of-year isolation should not be modified.

- Run an Accounting Recalculation in the current area to set the new periods and to check that no errors have appeared since you closed the year.

The close year process is now complete and you can work in CATS as normal.