This is an old revision of the document!

Using the Accounts Names and Address Feature

Use the Accts: Name/Addr feature to quickly access and update account information. For each account, you can review and update information including account addresses, account phone numbers, payment information, exposure information, and credit information.

Review Account

You can use the Review option to look at or edit an account, to add addresses to an account, and to print statements, invoices and envelopes for an account. You can also delete an account in Review.

Go to Accounting > Accts: Name/Addr > Review.

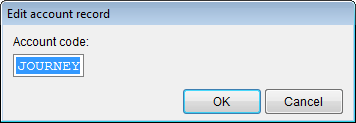

A dialogue box will open and ask you to enter the code of the account that you want to look at. Enter the code of the account you wish to review. Then press OK.

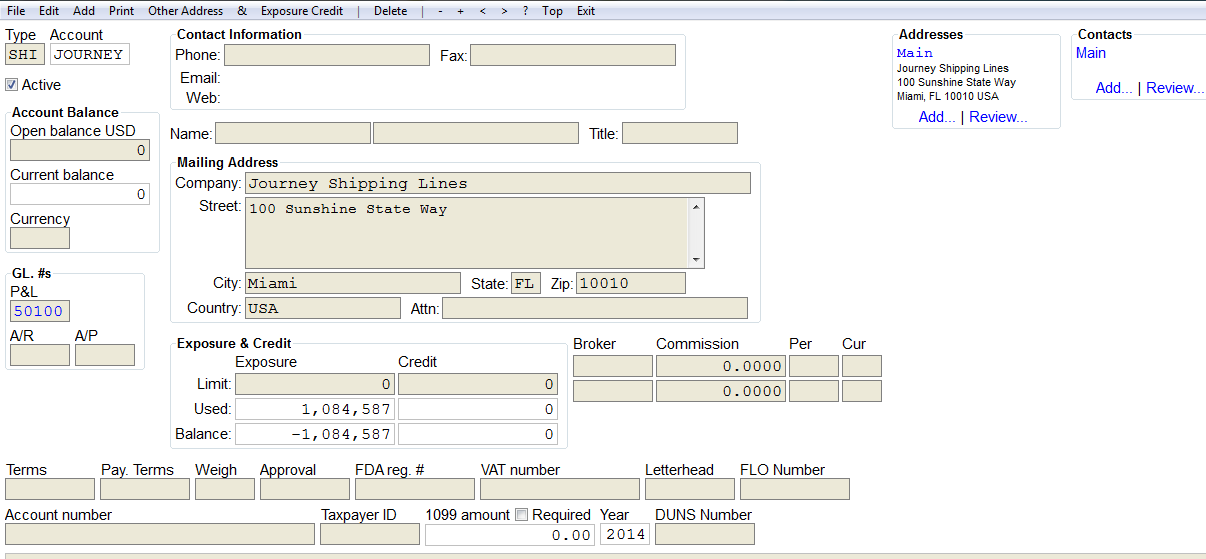

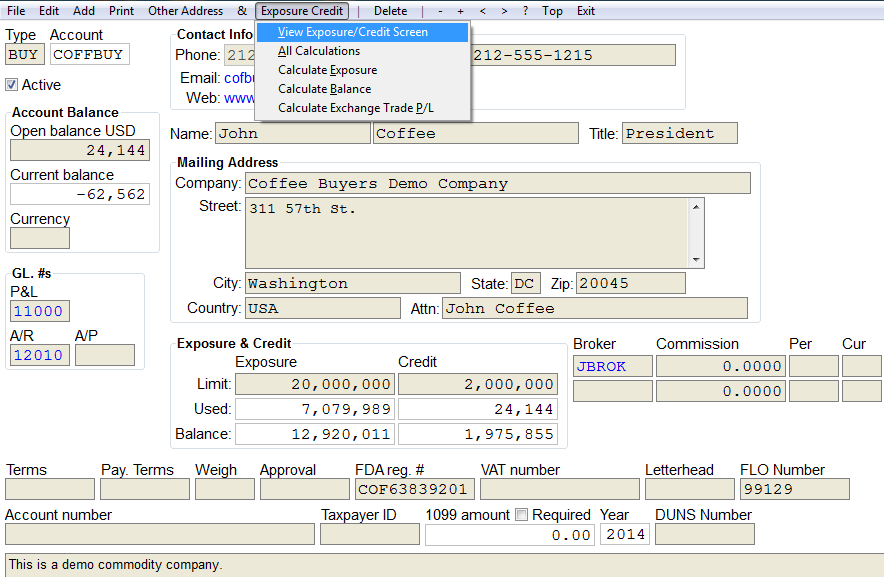

Below is a sample account opened in review mode. Let's look at the tools reviewing an account offers you.

- File - takes you to CATS main menu.

- Edit - choose edit to make changes in this account.

- Add - add an account

- Print - print an invoice report or an account statement for an account.

- Other Address - add an additional address for this account.

- & - add a note on this account.

- Exposure Credit - view the exposure/credit screen.

- Delete - delete this account.

On this screen is all the account information.

- Account - name of account.

- Contact information - Phone, fax an email information.

- Account balance - Open and current account balance.

- Mailing Address -

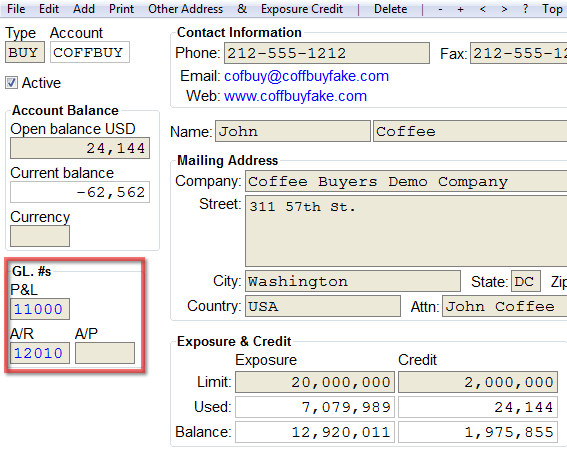

- GL numbers - On the left side of the screen are the GL numbers. This is a useful feature for handling inter-company accounts.

- Exposure and Credit - see details below.

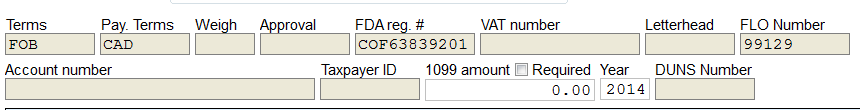

- Payment Terms - At the bottom of this screen are the payment terms.The payment terms and weight will be pulled in from the contract.

- Approval - is whether or not you need pre-shipment approval.

- The Taxpayer ID and 1099 amount and required year are used by those companies with 1099 reporting requirements.

- Letterhead - is not needed.

- FLO -

Exposure

The Exposure is based on fixed price contracts. The exposure is the amount of open sale invoices plus the portion of sales contracts that have not been invoiced. Go to Exposure Credit on the top menu.

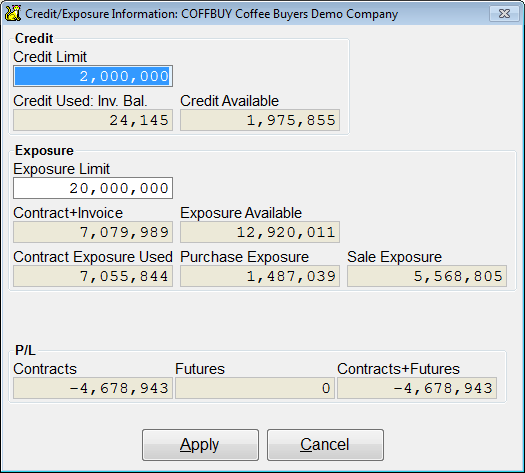

Then go to View Exposure/Credit Screen to view and/or edit the exposure and credit limits.

- Credit Limit - the amount of open sale invoices you can use.

- Credit Used - the amount of the credit limit that is used.

- Credit Available - the amount of credit left to use.

- Exposure Limit - the amount of open sale invoices plus the total value of un-billed open sale contracts.

- Contract + Invoice - total of open and billed invoices.

- Exposure Available - maximum value of exposure.

- Contract Exposure Used -

- Purchase Exposure -

- Sale Exposure -

- P/L -