Entering Receipts in CATS

This is a step-by-step guide to entering receipts in CATS.

Quick Guide Steps

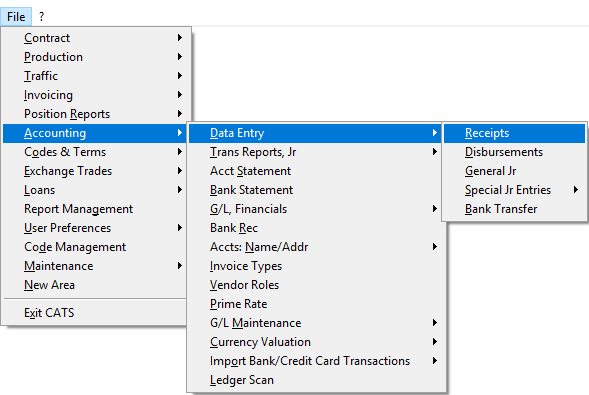

- From the main menu, go to Accounting > Data Entry > Receipts.

- Select Add from the menu.

- Enter the Bank account and click Apply.

- Choose an entry method (described in detail below).

- Input the Date, Number of Items, and Deposit Amount on the deposit slip. CT#, Note, and Bank Statement information are optional.

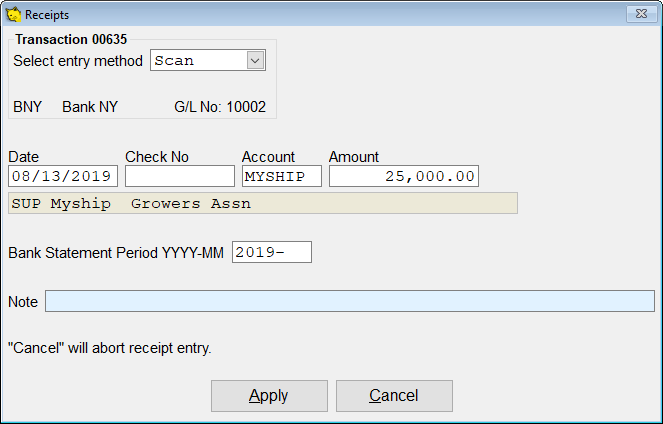

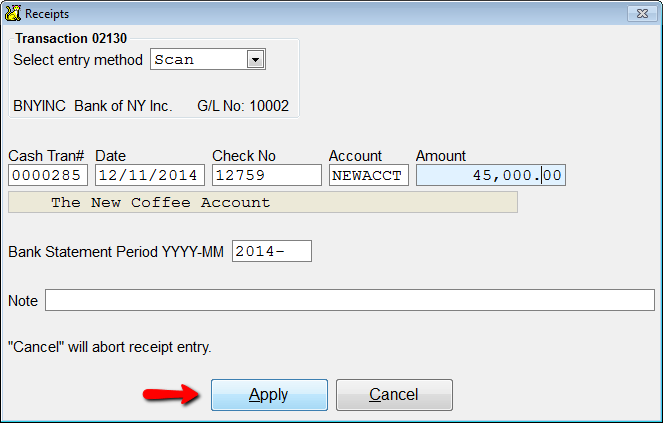

- Enter the Date, Account Code, and Amount. The Note and Check number are optional.

- Select invoices to pay from the list or from the chooser, or enter an amount against a G/L number. Continue until you have balanced the transaction.

- Select Continue to return to the add disbursements dialogue.

- Select Print from the scan to print and preview your disbursements.

- Pick Print Checks to print a check from CATS (optional).

- Select Post to post your disbursements to the general ledger.

Entering Receipts

In general, receipts are used to apply payments received by you to your sales invoices, to a counterparty account, or to a general ledger account. CATS uses double-entry bookkeeping to credit bank G/L accounts and put the debit against other G/L accounts (A/R, etc.).

From the main menu, select Accounting > Data Entry > Receipts.

You will see a scan of pending (unposted) receipts entered by your user ID. Select Add from the toolbar menu to create a new receipt.

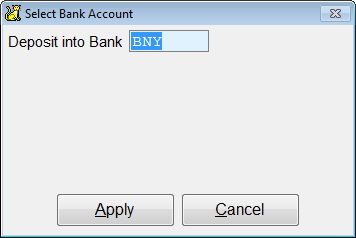

In the Select Bank Account box, fill in the appropriate bank code in the Deposit into Bank field, then select Apply to continue.

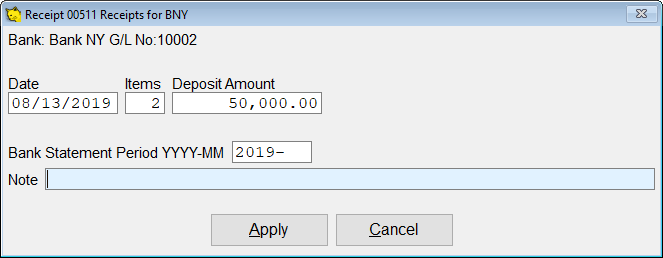

Deposit Slip

Receipts use a format that mimic bank deposits, so there is an overarching Deposit Slip that can hold multiple checks, each for a different account.

Next, CATS will prompt you to supply details about the Deposit Slip portion of our receipt. Enter a Date, number of Items (the checks we received), Deposit Amount and Note (optional).

The item number refers to the number of checks (or other entries) you will include on this one receipt. If you received two checks from the same account, you can choose to enter one item for both of them, but this entry may not match your bank statement.

Select Apply to proceed.

Check (Item) Entry

Next, we will enter each check that we received and apply them to invoices (or an account). Select your entry method.

Below is a description of each method.

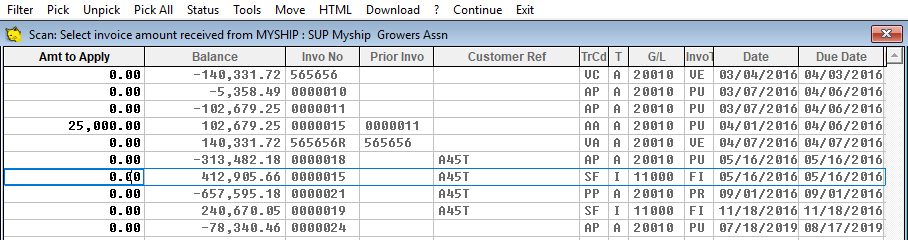

Scan Entry Method

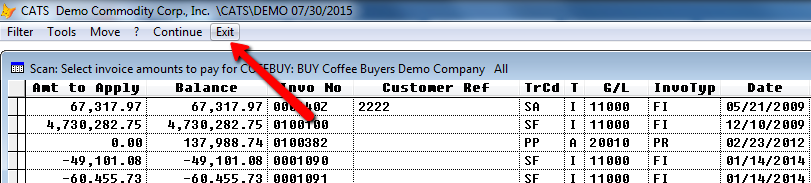

The scan entry method for adding a receipt lets you see a list of invoices dated before the deposit date that have open balances. Negative balances are payable (due someone else); positive balances are receivable (due you). If you pick this method, you will see a list of open invoices to choose from.

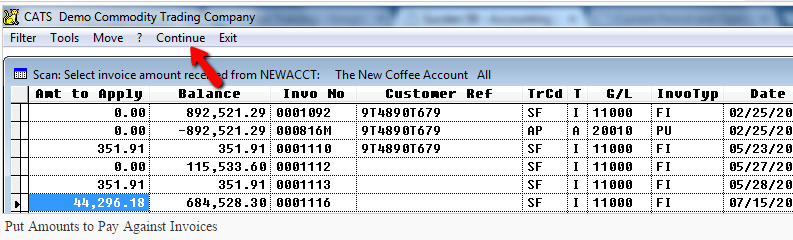

Place your cursor on the line item for the correct invoice. In the Amount to Pay column you can enter the amount you wish to pay against each invoice.

Invoice Scan Tools

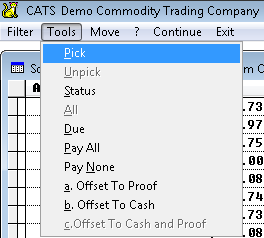

Other payment options are available in the Tools menu.

- Pick: Pay the selected invoice in full.

- Unpick: De-select this invoice. Blanks out the Amount to Pay field.

- Status: Displays the box shown below, which shows information about this receipt.

- All: Shows all open invoices for this account. Removes viewing filters (such as the one shown when changing the Due Date) in the Status box.

- Due: Change the Due Date filter to show invoices with future due dates. If you cannot find an invoice to be paid and know it should be showing on this screen, try changing this Due Date field.

- Pay All: Pays the balance on all of the invoices on the scan.

- Pay None: Removes all amounts from the Amount to Pay column for all line items.

- a. Offset to Proof: Takes the offset amount (amount left over) and puts it in a Proof G/L account. You can choose the G/L account to use in a later step.

- b. Offset to Cash: Takes the offset amount (amount left over) and puts it against a Cash G/L account. The Cash G/L account is usually the bank account.

- c. Offset to Cash and Proof: Takes the offset amount (amount left over) and splits it between the Cash G/L account and a Proof G/L account.

- Proof Amount: The amount of money left on this receipt item (check) that needs to be offset using a proof account.

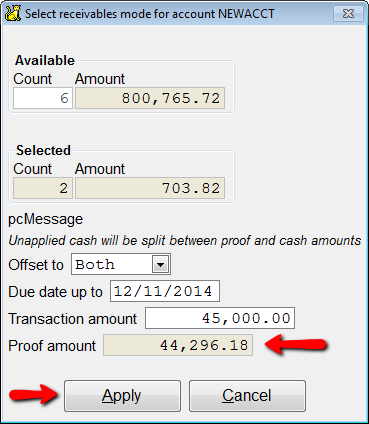

At any time, you can choose the Tools > Status option to see if you have any proof amount for this transaction. The status box displays more information about and extra options for creating this transaction.

- Available: Details the count of items available and the total amount available to pay (adds up the balance of all the open invoices).

- Selected: Shows the number of invoices selected to pay against and the total amount you have chosen to pay against them.

- Offset to Options: Functions in the same way as the Offset to options above. Choose Both, Proof, or Cash.

- Due Date up to: Allows you to view invoices with due dates in the future. The default due date range is today's date.

- Transaction Amount: Displays the total amount of the disbursement as entered by you.

- Proof Amount: Displays the amount to be offset to a separate G/L number(s).

In the status box above, we can see that our initial check was for 45,000.00, but I have only chosen two invoices for $703.82. I will need to apply the other $44,296.18 to another invoice or to a proof account, as shown below.

When you have finished with the status box, select Apply (or Cancel to cancel changes) to close it and return to the invoice scan.

Choose Continue to apply cash against these invoices and return to adding receipts.

You will return to adding checks to this bank deposit. Continue adding checks with the scan method, or use one of the methods described below to finish this receipt.

The Account Entry Method

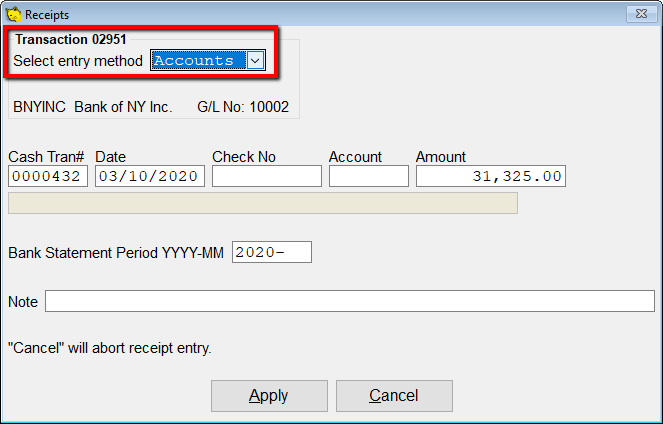

Another method is to apply the receipt directly to an account code, but to offset the proof in another way. First, choose the Account entry method on the top part of the receipt entry.

After you enter the relevant information and pick Apply, you will be presented with a choice.

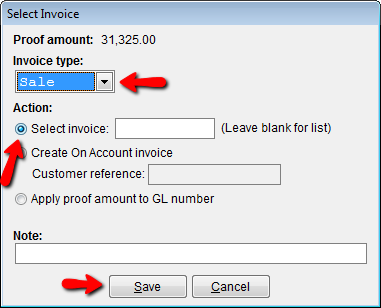

Entering an Invoice Number

Enter an invoice number for that account in the field provided. This is useful if you need to put money against an invoice that does not have an open balance, or if you know the invoice number and do not want to scan through a large list of numbers.

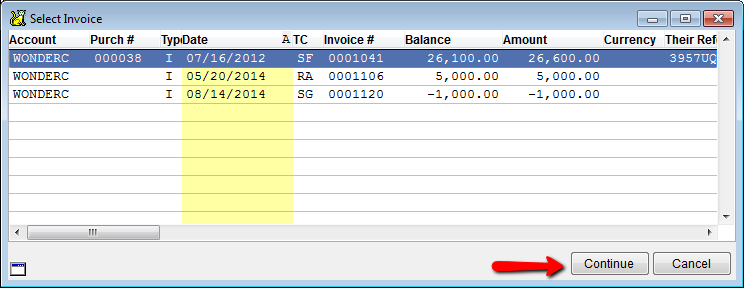

If you choose to Select invoice: Leave blank for list, but leave the field blank, you will see the invoice chooser. Pick an invoice from the list and choose Continue to proceed.

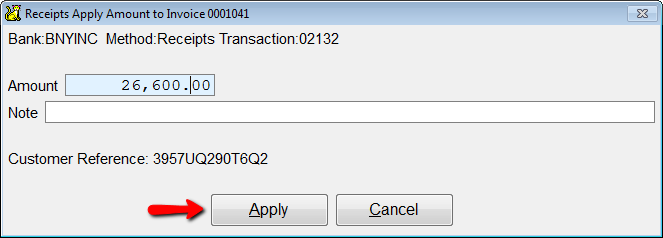

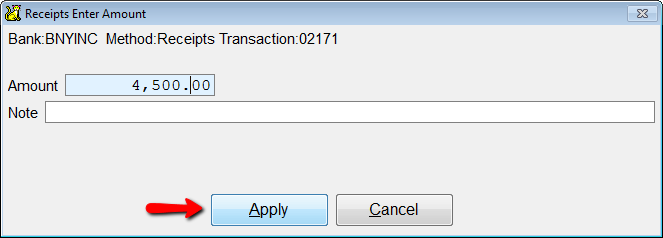

You will then be asked to enter the amount to apply to this invoice. Fill this in, then pick Apply.

You can repeat this process for multiple invoices until you are finished applying the receipt.

On Account Invoices

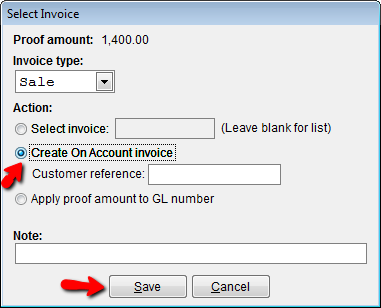

If you need to enter an amount against an account, but do not want to create a simple credit or debit to the account code, you can choose to Create an On Account invoice. You can fill in an optional reference number in the field provided to help you identify this invoice..

An On Account invoice is an invoice that CATS creates for you - visible only in the general ledger scan, not from the invoicing area) - that can be paid off like any other invoice. It allows you to apply an amount to this account, indicating that an amount was received from an account for an invoice that does not exist in CATS.

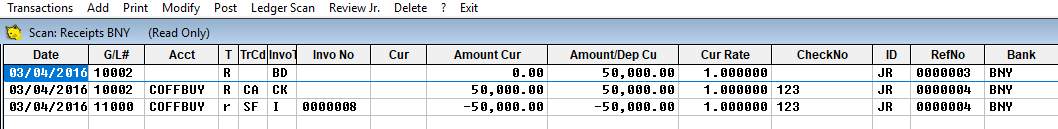

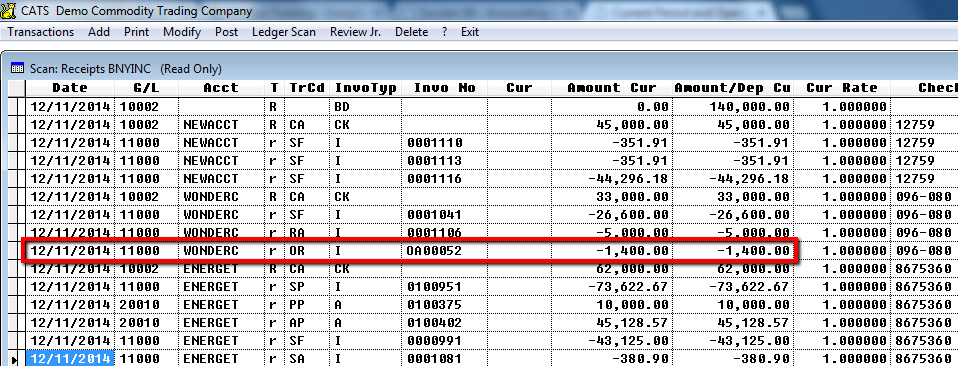

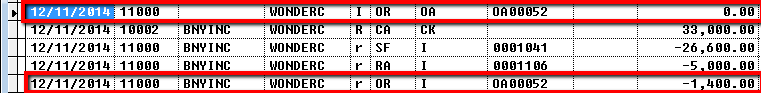

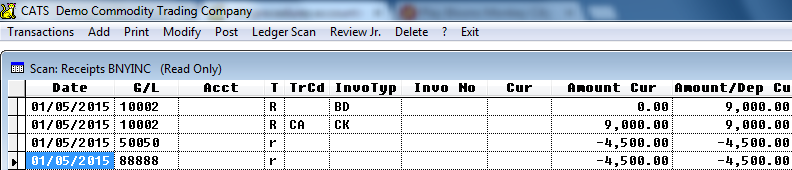

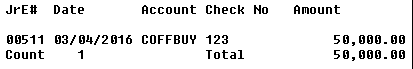

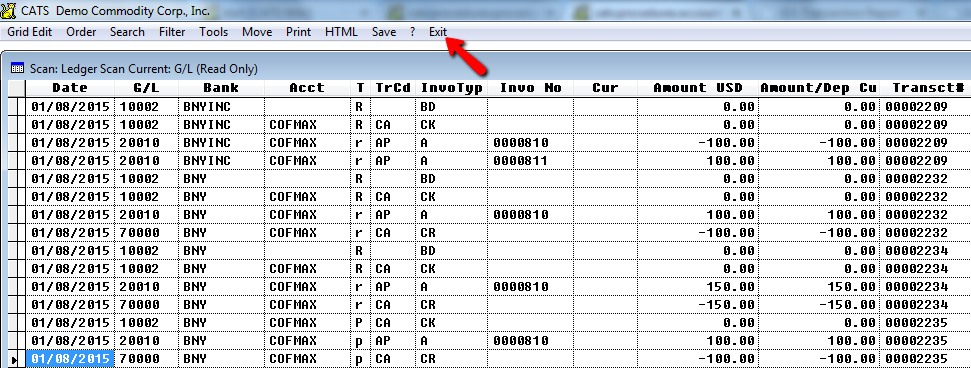

Here is an example of an OA invoice in the pending receipt scan as part of a bank deposit.

First, you would let CATS create the OA invoice for you, and when you printed and posted it CATS will add an entry to the general ledge as shown in the image below.

Then, if an actual invoice comes in for this account, you could enter the invoice into CATS, then reverse the OA invoice entry or pay off the OA invoice and the regular invoice in one transaction.

Proof Amount

The proof amount is used if the exact amount you are entering on either receipts or disbursements does not match the amount on the invoice.

If you select Apply a proof amount directly to a G/L number, this will create a credit for that account code that does not reference any invoices, with the offset going to a proof G/L number. You can enter the proof amount to several G/L account numbers.

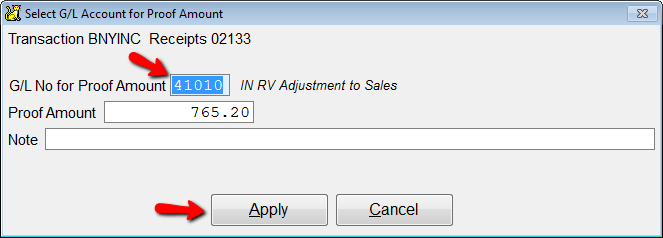

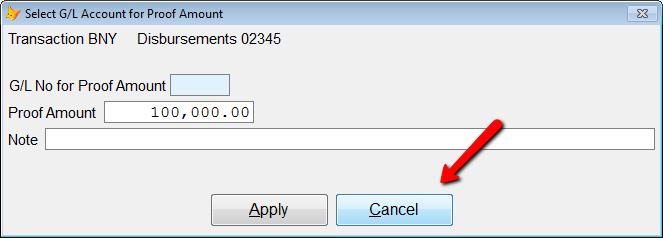

In this example, the client has sent us a check for $305,000.00, but the invoice was for only $304,234.80. When we click Continue after filling in the amount to apply, we see that CATS is asking us to choose a G/L number for the proof amount.

Change the G/L No for Proof Amount as needed, then fill in the optional note field to indicate the reason for this proof amount. Choose Apply to proceed with adding items to this receipt.

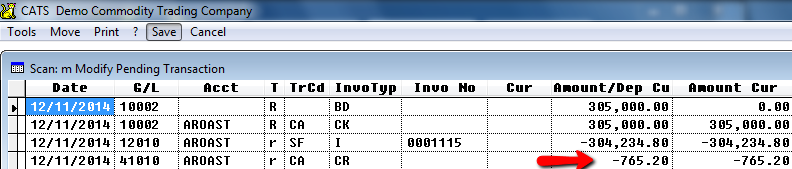

CATS will create another line item on the transaction, displaying this proof amount and putting it against that G/L number.

G/L Acct Method

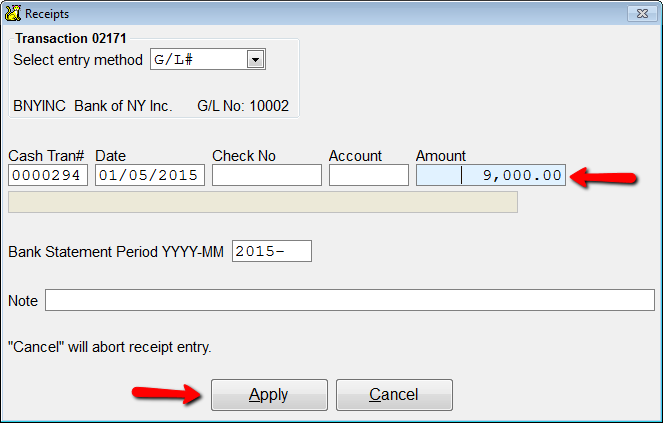

After entering the deposit slip amount, the check (item) entry screen will appear. Here, you only need to enter the amount of the first item.

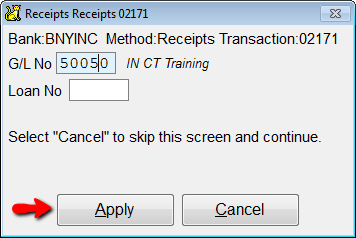

You will be asked for a G/L number, as shown below. Enter an appropriate G/L number and select Apply to continue. You can also enter a Loan Number if you wish to reference a loan.

Next, input the amount to apply toward the balance (the amount of the deposit is automatically entered).

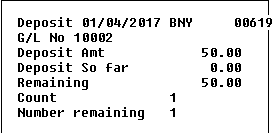

Continue applying money toward G/L accounts until you are finished and the proof amount equals zero. Here is a simple G/L method receipt in the pending scan.

As you can see, the G/L number for the bank is credited, with two other G/L numbers being debited.

Multiple items

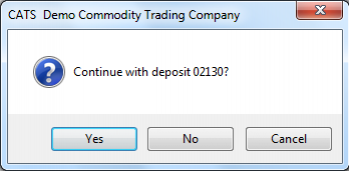

Receipts that have multiple items will prompt you between items to continue with adding the deposit.

Decreasing Item Count

Select Yes to proceed or No to cancel. If you cancel, you will be asked to adjust the item count down by one on the deposit.

Choose Yes to finish with the receipt and put the remainder of the deposit against a proof account. Click No to return to adding checks to the deposit.

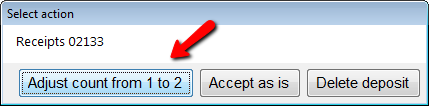

Increasing Item Count

If you originally entered the number of items as three, but when you have finished adding three items the proof amount is not 0.00, you will be asked to adjust the item count on this deposit, increasing it by one.

Again, pick Yes to finish with the receipt or No to return to adding checks to the deposit.

The Amount will be filled in automatically if there is only one check. If there is more than one check, when you are doing the last check CATS will fill the leftover amount in automatically.

Note the two boxes at the bottom of the screen pictured above.

The box at the lower left of the screen keeps track of the progress of the receipt entry.

The box at the lower right shows the most recent receipt transactions that you have entered and the total count and amount.

When asked if you want to change the default G/L account, select No (unless you are sure that this is the correct default G/L number).

Canceling Adding a Receipt

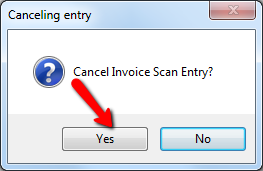

Each method has its own dialogue for canceling a receipt, but in general you will see the following prompts.

If you want to cancel adding a receipt from the invoice scan, select Exit from the menu.

You will be asked to confirm canceling the invoice scan entry. Select Yes to proceed to the proof amount prompt.

CATS will prompt you to apply the entire amount to a proof amount. You can choose to do so (see the section on proof amounts below) or you can click the Cancel button to cancel adding the transaction entirely.

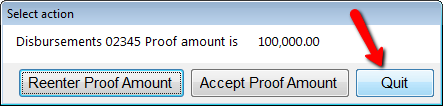

When canceling from a proof amount prompt CATS will ask if you wish to Re-enter or Accept the Proof amount. This will allow you to change the proof amount if you wish to continue with adding the receipt. Choose Quit to stop adding this receipt.

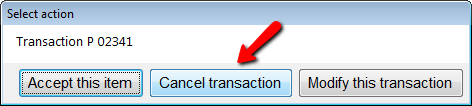

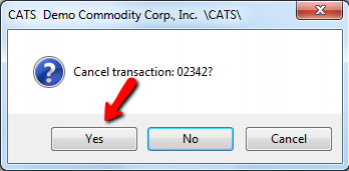

You will be asked to confirm cancellation. Select Accept this item to have CATS add the receipt, even if it is out of balance. Choose Cancel transaction to proceed with canceling.

When canceling from another prompt, you will be asked to confirm the cancellation action. Click Yes to cancel or No to continue adding the transaction.

CATS will show you the that the transaction has been canceled with a message in the upper right corner that lists the transaction number.

Printing and Posting Receipts

This section describes how to print and post receipts. After you enter receipts, you must print and then post before they affect the general ledger.

Printing Pending Receipts

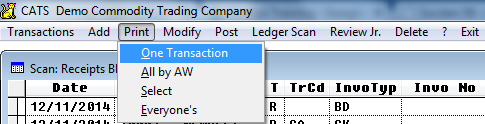

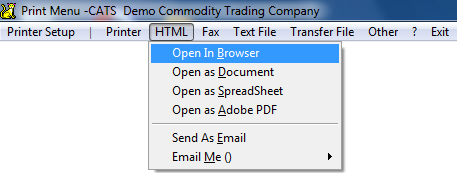

From the pending scan, pick Print > One Transaction, then choose the output as usual.

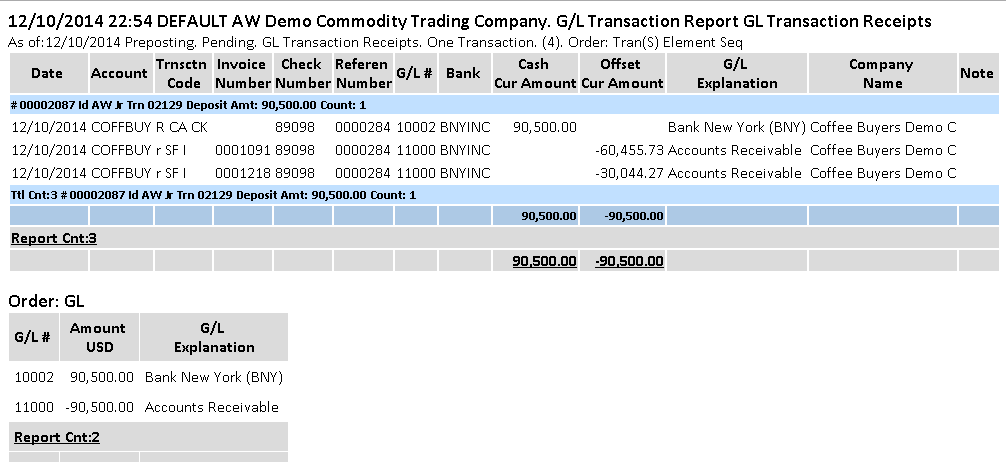

Here is a receipt printed to HTML > Open in Browser.

To print only receipts you have entered, select All by XX (your user name). The supervisor user ID can view and print receipts by all users.

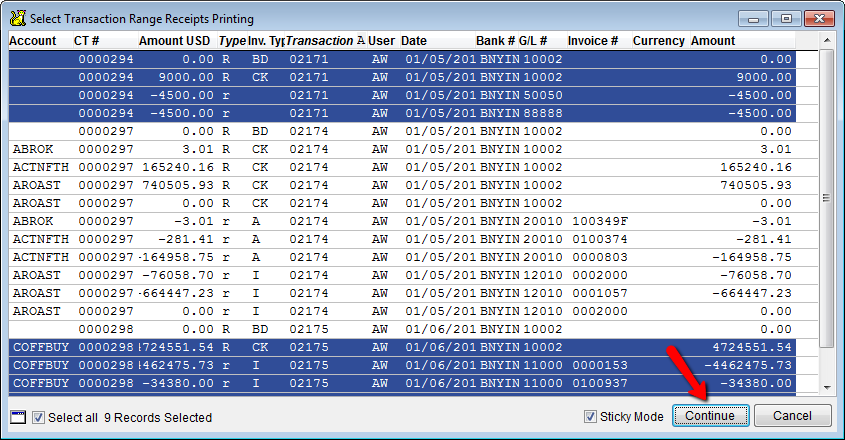

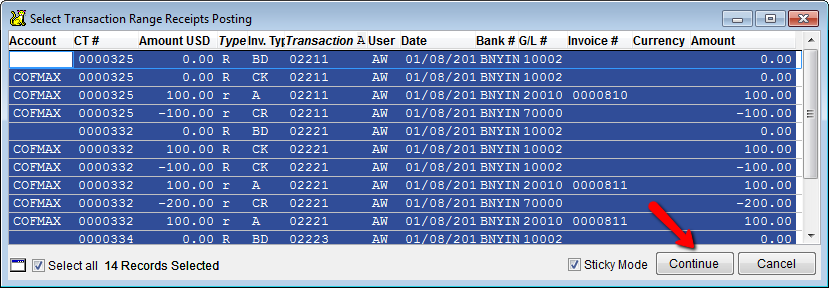

If you choose Select, CATS will ask you to specify which transactions to print. You will see a scan asking you to pick the transactions from a chooser. You only need to select one record for each transaction, and CATS will print the entire record.

Posting Receipts to the General Ledger

Receipts that have been previously printed and are in balance can be posted to the general ledger. This function works much the same as the printing feature described above.

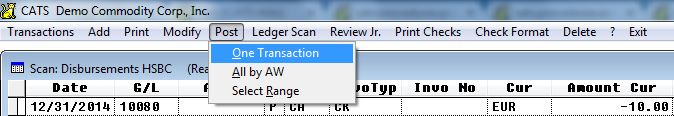

From the pending receipts scan, pick Post > One Transaction.

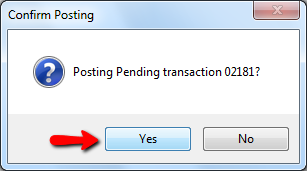

You will be asked to confirm posting this receipt. Select Yes to proceed or No to cancel. The number shown is the internal record number for this receipt. This number is shown in the scan to allow you to identify that receipt.

To post only your receipts, select All by XX (your user id). The Supervisor user ID can post receipts by all users.

If you choose Select, you will be asked to choose from a list of receipts. You only need to select one line for each receipt, and CATS will post the entire record.

Pick Continue to proceed with posting these receipts. You will see another confirmation dialogue; choose Yes to continue with posting.

After posting, the pending receipts scan will no longer show the receipt you posted. Select Ledger Scan from the toolbar menu to view the transaction you just printed.

Review the receipt, then select Exit to return to the pending receipts scan.

For more information on transactions, please see the index.