Invoice Types

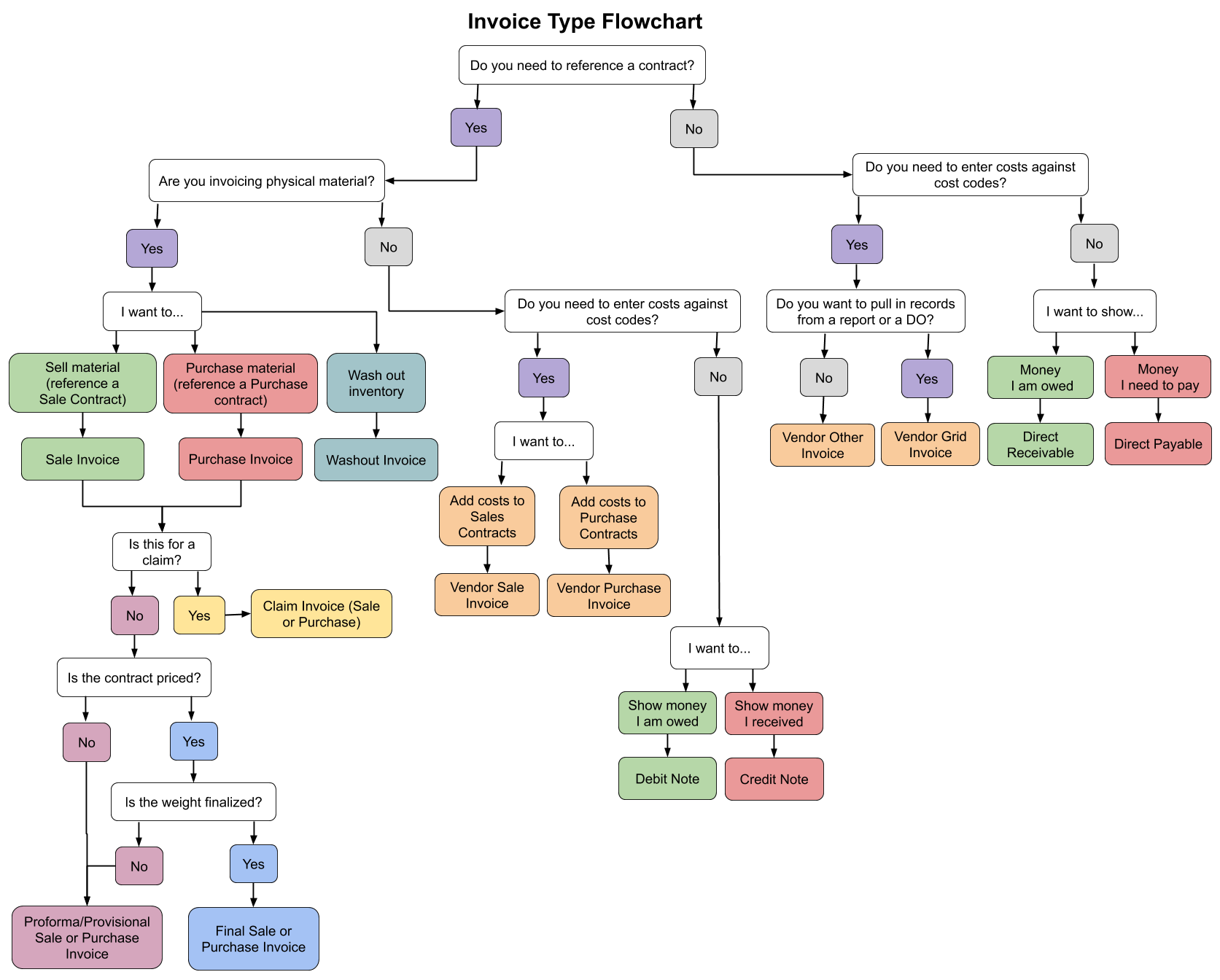

You can use various types of invoices to allow you to manage your inventory, costs, and other items in CATS. You can control the default G/L numbers and cost codes for these types and determine if they are final, provisional, or other invoices.

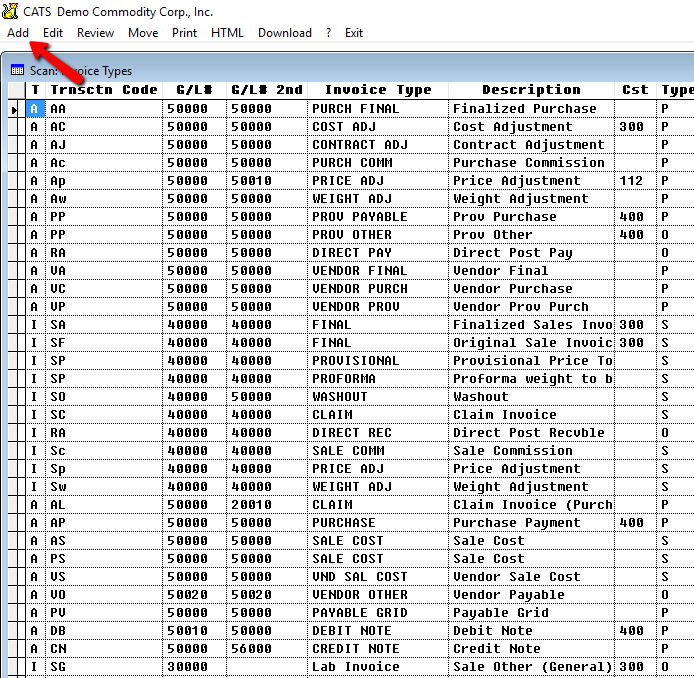

The invoice types are listed under Accounting > Invoice Types.

Check with New Data Systems before modifying or creating new invoice types.

System Default Types

- Provisional (price to be fixed) - An invoice for material with no final price.

- Proforma (weight to be fixed) - An invoice for material with no final weight.

Use transaction code

PP if you wish to be able to set a proforma percentage amount and show this as the amount due on the printed invoice. The full amount of the invoice will still post to the general ledger.

- Final - An invoice for material with fixed weight and price. Can be made as the original invoice or created by “Updating” a proforma or provisional invoice.

If you are using proformas that will be finalized, you should also create a type with transaction code

AA for finalizations.

- Claim Invoice - Special invoice for use with claims.

- Commission - Commission on sale or purchase invoices. This is not a separate invoice but a secondary charge on an inventory invoice. It has the same number as that of the inventory invoice.

- Weight Adjustment - Specialized invoice for noting lost bags or weight and calculating a new balance based on updated weight and/or units. Uses the weighing terms to find the franchise weight. Can only be made by “Updating” another invoice. Depending on your settings, weight and units on weight adjustment invoices may or may not be posted to the contract.

- Vendor Purchase - Vendor (cost) invoice that references purchase contract items but does not involve inventory.

- Vendor Other - Vendor (cost) invoice that does not reference a contract item.

- Vendor Sale Cost - Vendor (cost) invoice that references sale contract items.

- Vendor Order - A specific invoice type (VR) is required to use the vendor orders to generate a vendor invoice payable.

Choose Add to create a new type.

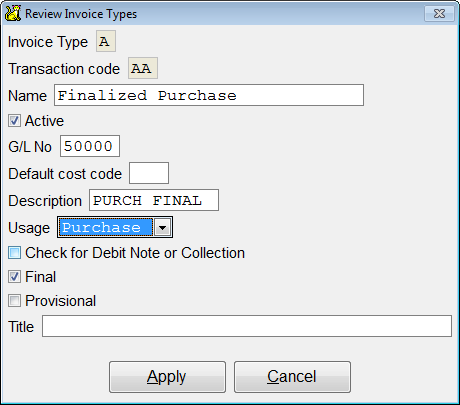

Invoice Type Options

- G/L No - Enter the default G/L number to use for this invoice type.

- Cost Code - Enter a valid cost code to use for this invoice type.

- Usage - Select from Purchase, Sale, or Other to determine which contract type this invoice type can access. Use

Otherto indicate no contract. - Check for Debit Note or Collection - Check this box to use this invoice as a type Debit Note.

- Final - Check this box if you only want this type to be used to finalize a provisional invoice.

- Provisional - Check this box if you only want this type to be used as a provisional.

- Title - Enter a title to display for this type of invoice.

The first two characters of the Description field will be used as the “Transaction Type” on reports.

Enter the details and pick Apply to continue. You will then be able to use this invoice type in CATS.