Zero Default Currency Feature

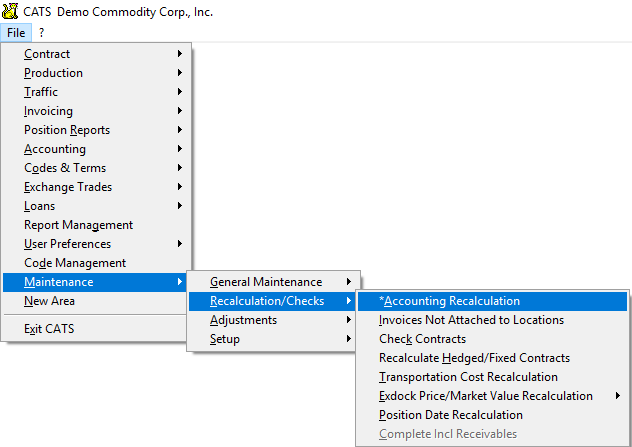

This is the procedure to zero out the default currency (USD) balance on invoices with no currency balance. For example, if you see an invoice has a 0.01 balance in USD but no balance in currency, you can use this procedure to make small transactions in the Currency P&L account to zero out these invoices. It is run from the accounting recalculation feature. Go to Maintenance > Recalculations/Checks > Accounting Recalculation.

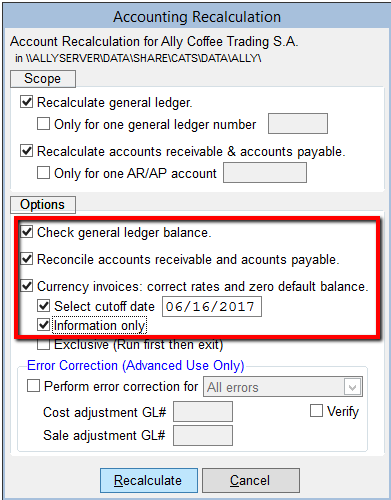

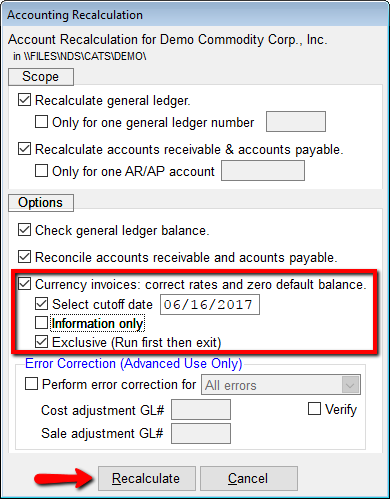

First, you should run this procedure with Information Only to see what CATS will do for the balances. Check the options for

- Check general ledger balance.

- Reconcile accounts receivable and accounts payable.

- Currency invoices: correct rates and zero default balance. Select cutoff date (enter last date to use, so today's date). Information only.

Pick Recalculate to proceed.

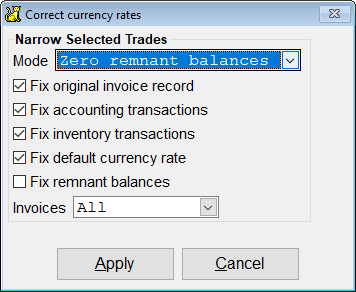

CATS will show you the options you should use for this feature. Leave the options checked as shown and pick Apply.

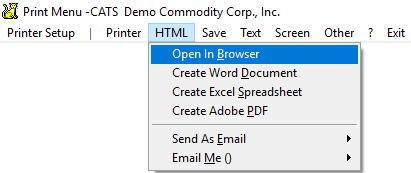

Choose where to print the report of changes CATS will make.

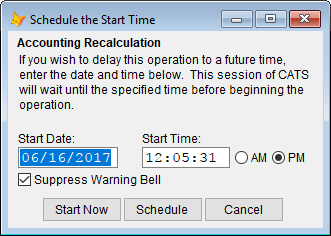

Choose Start Now to begin the recalculation.

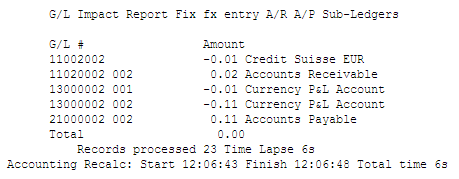

CATS will print out a list of transactions it will change.

If the information looks correct, you can then run the procedure for real. Here are the options you should use to run the procedure. You must un-check the Information only box. The Run first then exit option will let you perform this procedure without having to recalculate the entire system again. Pick Recalculate to proceed.

Choose where to print the report of changes CATS will make.

Choose Start Now to begin the recalculation.

Review the printout to ensure that everything looks correct.