Why Can't I Unpost a Specific Invoice?

Occasionally, CATS will prevent you from unposting certain invoices. This can be for several reasons, usually those detailed in this document. Please keep in mind that in general, you should only unpost invoices:

- Without transactions against them in the general ledger,

- From the current accounting period,

- That have not been sent to a counterparty.

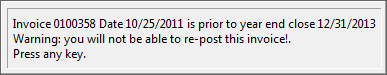

Prior Year Invoices

If you see a warning about the date on the invoice, the invoice you are attempting to unpost may be from the prior fiscal year. If you unposted it, you would no longer be able to re-post it.

Leaving a prior-year invoice unposted would cause the ending balances for the previous year to no longer match the opening balances of the current year, among other accounting errors.

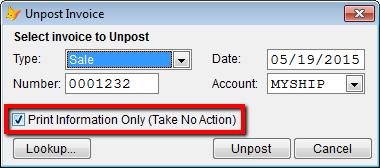

Information Only

If you do not receive this warning and the invoice is from the current year, you may have neglected to uncheck the “Information Only” check box on the invoice unposting dialogue.

This box is left checked by default whenever you enter the invoice unposting area.

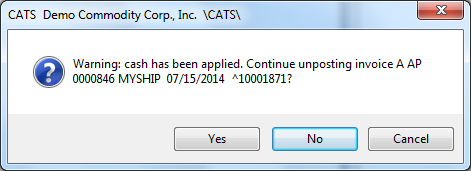

Transactions Against Invoices

If you receive a warning that there are transactions in the system for this invoice, you must decide if you wish to proceed with unposting this invoice.

You must perform an accounting recalculation after you have unposted an invoice with cash applied against it to ensure that the balances on the invoice will be properly calculated.

CATS is able in most cases to re-apply any transactions once you have re-posted the invoice, provided you do not delete the invoice or change the account or invoice date. Deleting the invoice creates an issue with an internal numbering system that CATS uses to attach transactions to invoices.