How to Use the Accounting Recalculation Report

The Accounting Recalculation procedure calculates balances on accounts in the Name/Address file and in the General Ledger. This procedure can also find incorrect items in the general ledger and report those errors to you on the printout.

Running an Accounting Recalculation

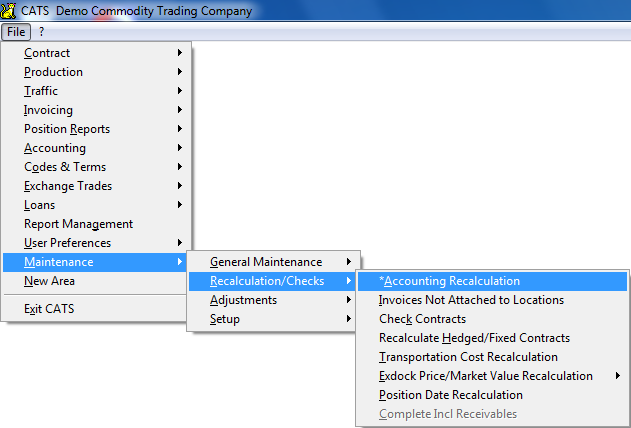

To run an accounting recalculation, go to Maintenance > Recalculations/Checks > Accounting Recalculation.

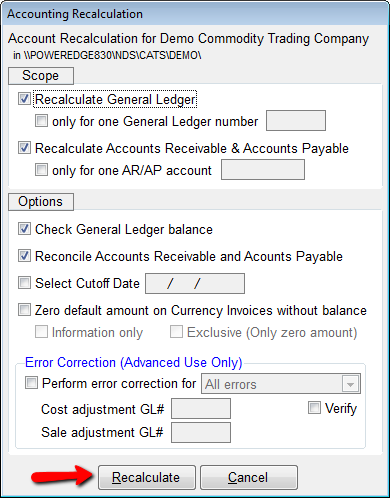

A list of options will pop up. Use the default options to see a normal recalculation. Click the Recalculate button to continue.

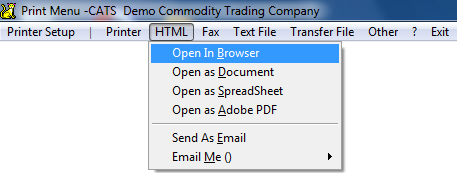

CATS needs to show you a printout of the recalculation result. For easy viewing on screen, choose HTML > Open in Browser. To look at a physical printout, pick Printer.

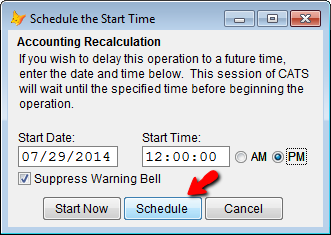

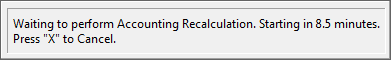

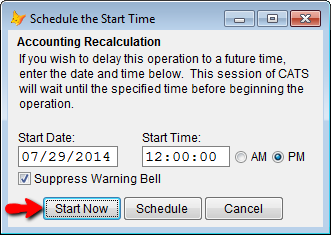

You have the option of scheduling the accounting recalculation to run at a later time, or starting now. Choosing a different time and picking Schedule will cause this instance of CATS to remain in a waiting pattern until you either cancel the recalculation or the scheduled time begins.

A window will appear counting down to the recalculation start time.

To begin running the recalculation immediately, select Start Now.

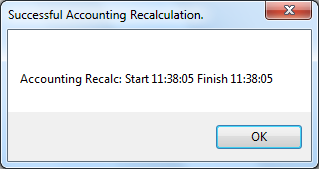

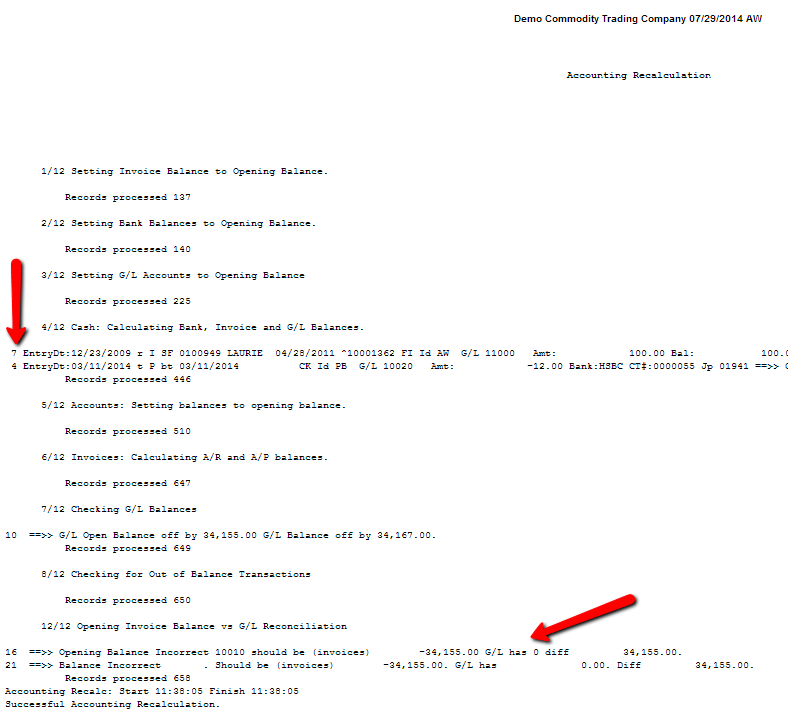

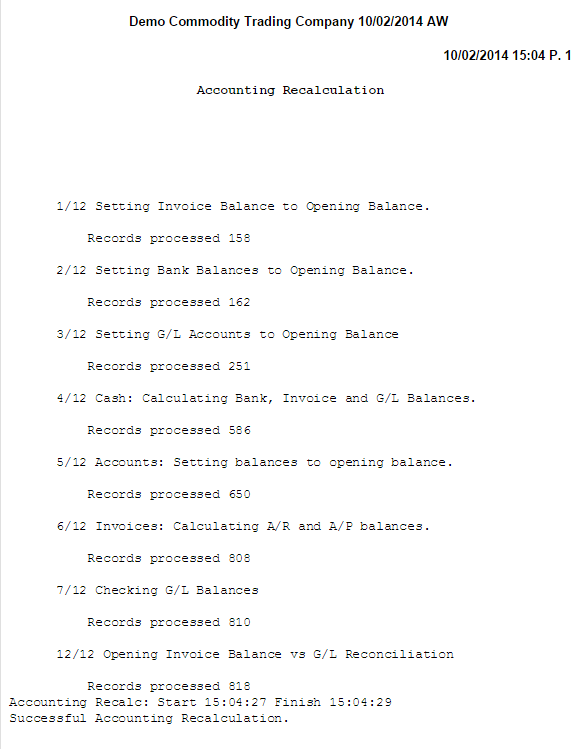

When finished, CATS will display a success message and the printed report, with any errors displayed with their corresponding error numbers.

Reading and Correcting Errors on the Report

CATS can use the accounting recalculation process to correct a number of errors by offsetting incorrect entries to a proof, suspension, or adjustments account. Here are detailed explanations and instructions on correcting each of these errors.

and choosing a G/L number for making any necessary adjustments.

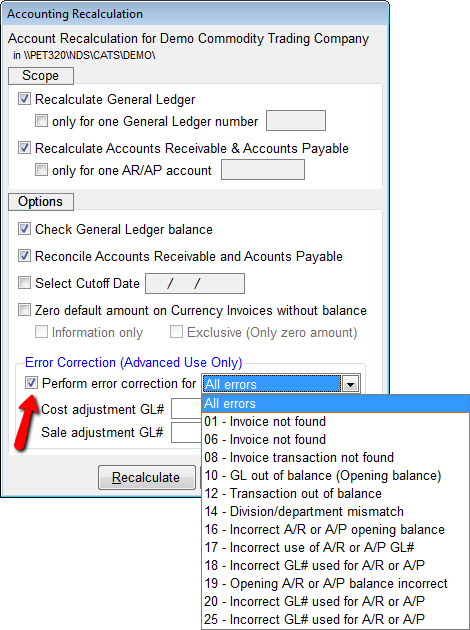

Check the Perform error correction box, then select from the list of errors.

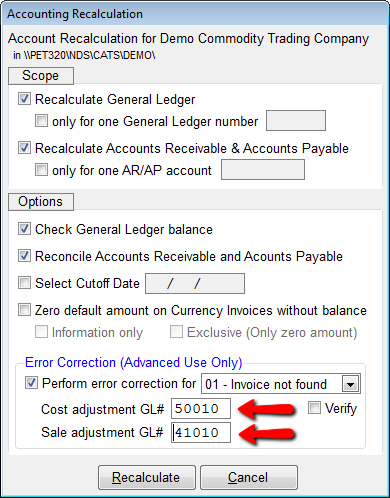

Enter a G/L number to use for Adjustments to Costs (A/P) and Adjustments to Sales (A/R).

Invoice Not Found

This error occurs when an invoice that has a general ledger transaction against it (disbursement or receipt) is deleted. If the transaction is against a purchase/vendor invoice, then the G/L account is switched from the A/P GL# to the account that you enter in the Cost Adjustment GL# field on the accounting recalculation screen.

If the transaction is against a sales invoice, then the G/L account is switched from the A/R GL# to the account that you enter in the Sale Adjustment GL# field.

Invoice Transaction Not Found

Similar to the above message, this error displays when a transaction that moved balances from one invoice to another is not found.

Transaction out of Balance

Typically transactions cannot be posted to the G/L if they are out of balance. It can happen that certain portions of a transaction can be deleted or modified in such a way that they are out of balance. CATS will delete the transaction if you choose to correct this error, so a second recalculation should be performed after error correction to ensure that no other items were affected.

Division/Department Mismatch

The division or department number on the transaction does not match that on the invoice or associated records.

Incorrect Use of A/R and A/P GL Number

If a non-invoice transaction (receipt or disbursement not applied to an invoice) or general journal entry affects A/R or A/P, then the transaction will be moved into the adjustment G/L account.

Incorrect GL Number for A/R and A/P Transaction

If a sales invoice debits an account other than A/R, or a purchase invoice credits an account other than A/P, then CATS will move the transaction into the A/R account marked GL_AR or the A/P account marked GL_AP.

G/L Balance Errors

The opening balance in the General Ledger for A/P and A/R accounts must match the balances on all invoices that were open as of the beginning of the year. The first number is the G/L account (either A/R or A/P) that is out of balance. The second number is the dollar amount of the open invoices. The third number is the dollar amount of the G/L account opening balance. The G/L account opening balance will be changed to match the open invoices and an opposite adjustment will be made to the suspense account.

Similarly, the current G/L balance must match the balances on all currently open invoices. An out of balance ending (or current) balance is usually caused by other errors on the recalculation. Fixing those errors will most likely remove the ending balance error from the report. Click here to see the wiki for more on matching the GL_AP and GL_AR numbers and finding discrepancies.

Zero Default Currency Balance Process

Differences in currency rates can cause this issue, where there is a balance left on invoices for the default currency but no balance in foreign currency. For example, an invoice can have a balance of 0.00 EUR but a USD balance of 0.03 due to varying currency rates.

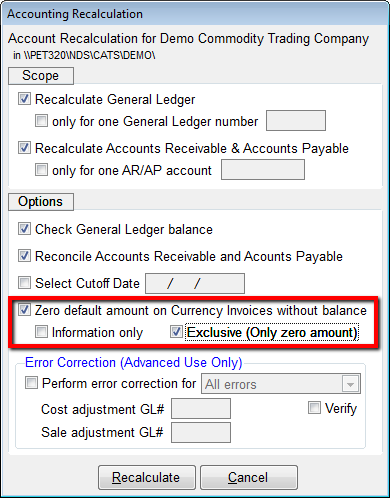

This is classified as a separate procedure on the Accounting Recalculation. You should run this operation by selecting the checkbox for Zero Default Currency Balance, then selecting the option for *Exclusive (Only zero amount)*.

CATS will pay off the default currency balances and put the proof amount to an adjustment G/L account that you enter.